Digital Marketing for Financial Services: Navigating the Digital Landscape

In today’s rapidly evolving financial landscape, digital marketing for financial services has become an indispensable tool for institutions looking to stay competitive and relevant. Digital marketing for financial services encompasses a wide range of online strategies and tactics designed to attract, engage, and retain customers in the digital realm. As traditional banking models continue to shift, financial institutions are increasingly recognizing the importance of leveraging digital channels to reach and serve their clientele.

Digital marketing for financial services goes beyond mere online advertising. It involves creating a comprehensive digital presence that includes websites, mobile apps, social media platforms, email campaigns, and search engine optimization. This holistic approach allows financial institutions to provide seamless, personalized experiences to their customers across various digital touchpoints.

Importance of Digital Marketing for Financial Institutions

The importance of digital marketing for financial services cannot be overstated. In an era where consumers expect instant access to information and services, financial organizations must adapt to meet these demands or risk losing market share to more digitally savvy competitors. Digital marketing enables banks, insurance companies, and investment firms to:

- Enhance customer engagement and loyalty

- Increase brand awareness and trust

- Generate qualified leads and conversions

- Provide personalized financial solutions

- Improve customer service and support

Overview of Key Trends in Digital Marketing

As we delve deeper into the world of digital marketing for financial services, it’s crucial to understand the key trends shaping the industry. These include:

- AI-powered personalization

- Voice search optimization

- Video content marketing

- Blockchain technology integration

- Increased focus on cybersecurity and data privacy

Understanding the Financial Services Audience

To effectively implement digital marketing strategies in the financial sector, it’s essential to have a deep understanding of the target audience. This knowledge forms the foundation for creating tailored marketing campaigns that resonate with potential customers and drive meaningful engagement.

Identifying Target Demographics

The first step in understanding the financial services audience is to identify key target demographics. These may include:

- Millennials and Gen Z: Young professionals seeking convenient, mobile-first banking solutions and investment opportunities

- Baby Boomers: Individuals nearing retirement age looking for wealth management and estate planning services

- Small business owners: Entrepreneurs in need of business banking, loans, and financial advisory services

- High-net-worth individuals: Affluent clients seeking premium banking services and sophisticated investment products

By segmenting the audience into distinct groups, financial institutions can craft targeted digital marketing campaigns that address the specific needs and preferences of each demographic.

Customer Personas and Their Needs

Once target demographics are identified, the next step is to create detailed customer personas. These fictional representations of ideal customers help marketers understand the motivations, goals, and pain points of different audience segments. For example:

- “Tech-savvy Sarah”: A 28-year-old urban professional who values mobile banking, automated savings tools, and investment apps

- “Retirement-ready Robert”: A 60-year-old baby boomer looking for comprehensive retirement planning and wealth transfer solutions

- “Entrepreneur Emily”: A 35-year-old small business owner seeking streamlined business banking services and access to working capital

By developing these personas, financial institutions can tailor their digital marketing efforts to address the unique needs of each customer type, creating more relevant and engaging content and offers.

Behavioural Insights and Customer Journey Mapping

To truly understand the financial services audience, it’s crucial to analyze behavioural insights and map the customer journey. This process involves:

- Analyzing data from website analytics, social media interactions, and customer feedback

- Identifying key touchpoints in the customer journey, from awareness to consideration to decision-making

- Understanding the pain points and obstacles customers face at each stage of their financial decision-making process

- Recognizing the preferred channels and content types for different audience segments

By gaining these insights, financial institutions can optimize their digital marketing strategies to deliver the right message, through the right channel, at the right time in the customer journey.

Building a Strategy of Digital Marketing for Financial Services

Setting Clear Goals and Objectives

The cornerstone of any successful digital marketing initiative in the financial services industry is the establishment of clear, measurable, and achievable goals. These objectives should be intimately aligned with your organization’s overarching business strategy and may encompass a variety of aims:

- Increasing brand awareness and recognition in a crowded marketplace

- Generating a steady stream of qualified leads for your sales team

- Improving customer retention rates through enhanced digital engagement

- Boosting online conversions, whether it’s account openings, loan applications, or investment product purchases

- Enhancing customer engagement and satisfaction through personalized digital experiences

By defining specific, quantifiable targets, financial services firms can more effectively allocate their resources, measure the success of their digital marketing efforts, and make data-driven decisions to optimize their strategies over time. It’s crucial to use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) when setting these goals to ensure they provide clear direction and accountability.

Conducting a Comprehensive Competitive Analysis

To stand out in the crowded financial services sector, it’s crucial to perform a thorough analysis of your competitors’ digital marketing for financial services strategies. This research should cover:

- A detailed examination of competitors’ websites, assessing user experience, content offerings, and product positioning

- Scrutiny of their social media presence, including engagement metrics, content themes, and audience interaction

- Evaluation of their search engine rankings for key industry terms

- Review of their email marketing initiatives, if available

- Analysis of their paid advertising approaches across digital platforms

This competitive intelligence will inform your own digital marketing for financial services strategy, helping you identify market gaps, uncover brand differentiation opportunities, and refine your approach. It may reveal untapped content niches, showcase effective engagement tactics, or expose weaknesses in competitor’s approach that you can leverage to your advantage.

Crafting a Compelling Unique Value Proposition

Developing a powerful and resonant value proposition is essential for cutting through the noise in the financial services sector. Your unique selling points should directly address the specific needs, pain points, and aspirations of your target audience. Consider the following when crafting your value proposition:

- What specific problems do your financial products or services solve?

- How do you deliver solutions better or differently than your competitors?

- What unique benefits or features set your offerings apart?

- How does your brand align with your customer’s values and goals?

Once defined, this value proposition should be consistently communicated across all digital channels, from your website and social media profiles to your email campaigns and paid advertisements. It should serve as the north star for your digital marketing efforts, ensuring that every piece of content and every customer interaction reinforces your unique position in the market.

Content Marketing

The Critical Importance of Content in Digital Marketing for Financial Services

Content marketing plays an indispensable role in digital marketing for financial services. In an industry built on trust, expertise, and long-term relationships, high-quality, informative content serves multiple crucial functions:

- Establishing credibility and thought leadership in a crowded marketplace

- Educating potential customers about complex financial products and services

- Building trust by providing valuable, unbiased information

- Improving search engine visibility and driving organic traffic

- Nurturing leads through the sales funnel with targeted, relevant information

- Addressing common customer questions and concerns, reducing the burden on customer service teams

By consistently producing valuable content, financial institutions can position themselves as trusted advisors rather than mere service providers, fostering deeper, more lasting relationships with their audience.

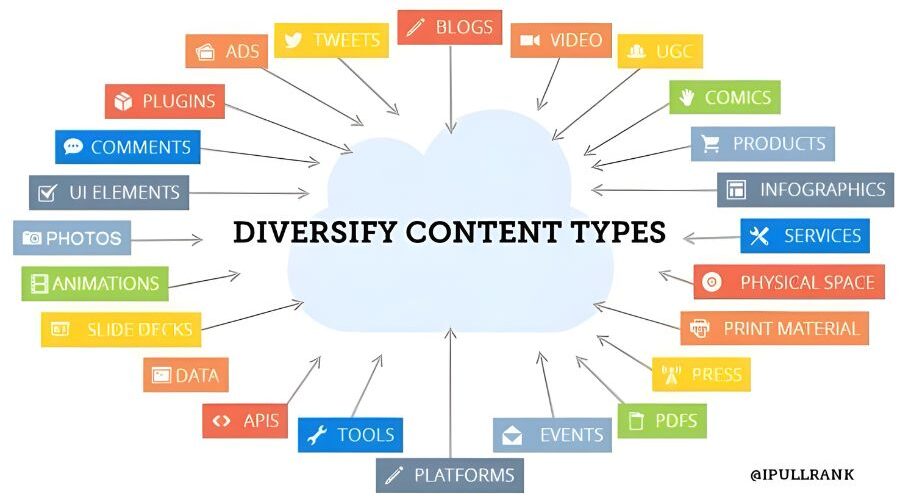

Diverse Content Types for Comprehensive Engagement

To effectively reach and engage different segments of your target market, it’s essential to diversify your content offerings. Each content type serves a unique purpose in your digital marketing strategy:

Blogs and Articles: Regular blog posts on relevant financial topics can improve SEO, drive organic traffic, and showcase your expertise. Topics might include market analyses, financial planning tips, regulatory updates, or explanations of complex financial concepts.

Whitepapers and In-Depth Reports: Comprehensive reports on industry trends, economic forecasts, or specific financial solutions demonstrate your company’s deep knowledge and authority. These pieces can be particularly effective for lead generation and nurturing high-value prospects.

Case Studies and Success Stories: Real-world examples of how your services have helped clients overcome challenges or achieve their financial goals can build credibility and trust. These narratives make your services tangible and relatable to potential customers.

Videos and Animations: Engaging video content can simplify complex financial concepts, showcase your brand personality, and appeal to visual learners. Consider producing explainer videos, market updates, client testimonials, or behind-the-scenes glimpses of your company culture.

Infographics and Data Visualizations: These visual assets can distil complex financial data or concepts into easily digestible formats, making them highly shareable on social media and effective for building brand awareness.

Interactive Tools and Calculators: Offering practical tools like retirement calculators, budget planners, or investment return estimators can provide immediate value to your audience while showcasing your expertise and gathering valuable data about your prospects.

Strategic Content Creation and Distribution

To maximize the impact of your digital marketing for financial services, develop a comprehensive content creation and distribution strategy that encompasses:

- Thorough audience research to identify key topics, themes, and formats that resonate with your target market

- Creation of a detailed content calendar to ensure consistent publication and alignment with business goals and seasonal trends

- Implementation of SEO best practices to improve content visibility in search engine results

- Strategic use of social media platforms to amplify your content’s reach and engage with your audience

- Utilization of email marketing to distribute content directly to subscribers, segmented by interest and stage in the customer journey

- Exploration of paid advertising options, such as sponsored content or pay-per-click campaigns, to boost content visibility and reach new audiences

- Development of a content repurposing strategy to maximize the value of each piece of content across multiple formats and channels

By implementing these strategies and focusing on creating valuable, relevant content, financial services companies can effectively leverage digital marketing to attract, engage, and retain customers in an increasingly competitive and digital-first landscape. The key to success lies in consistently delivering high-quality, trustworthy information that addresses your audience’s needs and positions your brand as a reliable partner in their financial journey.

Search Engine Optimization (SEO)

SEO Basics for Financial Services

Search Engine Optimization is a fundamental pillar of digital marketing for financial services. It involves a series of techniques and best practices aimed at improving a website’s visibility in search engine results pages (SERPs) for relevant keywords. For financial services providers, effective SEO can mean the difference between being discovered by potential clients or being lost in the vast sea of online information.

To implement robust SEO strategies in the financial sector:

Ensure Technical Excellence: Your website should be technically sound, with fast loading times across all devices. This is particularly important for financial services websites, as users expect quick access to sensitive information. Implement secure HTTPS protocols, optimize images, and leverage browser caching to enhance site speed.

Prioritize Mobile Responsiveness: With an increasing number of users accessing financial information on mobile devices, your website must provide a seamless mobile experience. Google’s mobile-first indexing means that the mobile version of your site is now the primary version considered for ranking.

Create High-Quality, Informative Content: In the financial sector, trust is paramount. Develop comprehensive, accurate, and up-to-date content that addresses your target audience’s needs, questions, and concerns. This could include detailed guides on financial products, market analysis reports, or educational resources on personal finance.

Optimize Website Structure: Implement a clear, logical site structure that allows users and search engines to easily navigate your content. Use breadcrumbs, clear menus, and a well-organized hierarchy of pages to improve user experience and search engine crawlability.

Implement Schema Markup: Utilize financial-specific schema markup to help search engines better understand your content. This can include markups for financial products, services, and even customer reviews, potentially leading to rich snippets in search results.

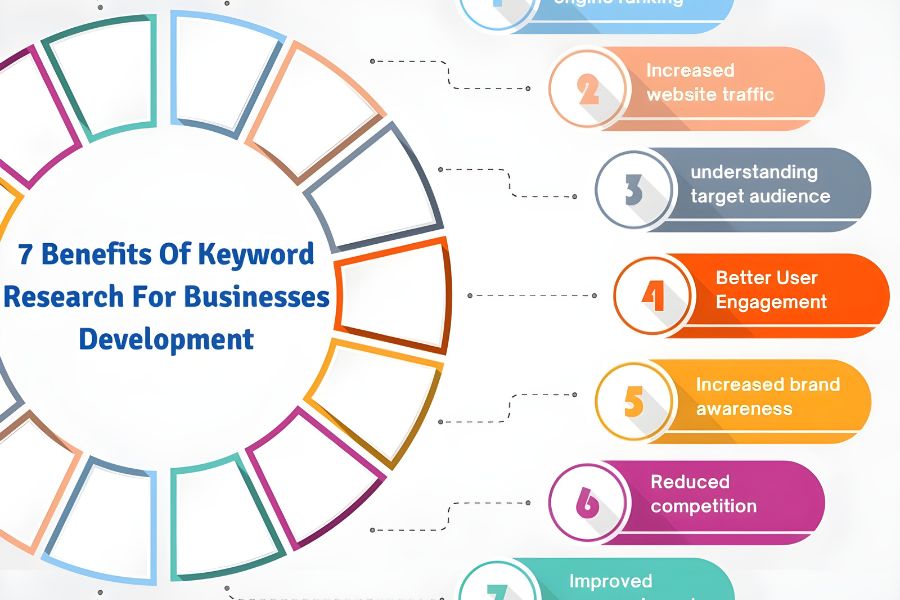

Keyword Research and Optimization

Keyword research is a critical component of digital marketing for financial services. It involves identifying and analyzing the terms and phrases that potential clients use when searching for financial products or services online. This process helps you understand user intent and tailor your content to meet those needs effectively.

To conduct thorough keyword research:

Utilize Advanced Tools: While Google Keyword Planner is a good starting point, consider investing in more advanced tools like SEMrush, Ahrefs, or Moz Pro. These tools offer deeper insights into keyword difficulty, search volume trends, and competitor analysis specific to the financial sector.

Focus on Long-Tail Keywords: In financial services, many searches are specific and complex. Long-tail keywords (e.g., “best mortgage rates for first-time homebuyers”) often have less competition and higher conversion rates than broader terms.

Consider Localization: If your financial services are location-specific, incorporate local keywords into your strategy. For example, “investment advisor in [city name]” or “small business loans in [state]”.

Analyze Competitor Keywords: Identify the keywords your competitors are ranking for and evaluate whether these terms align with your services and target audience.

Once you’ve identified your target keywords:

- Incorporate them naturally into your website’s content, including page titles, headers, meta descriptions, and throughout the body text. Avoid keyword stuffing, as this can negatively impact your rankings and user experience.

- Create dedicated content pieces around specific financial topics related to these keywords. This could include in-depth articles, whitepapers, or even interactive tools that provide value to your audience.

- Regularly update your content to ensure it remains relevant and valuable. The financial industry is dynamic, so your content should reflect the latest trends, regulations, and market conditions.

- Use keywords in URL structures when appropriate, creating clean, descriptive URLs that both users and search engines can easily understand.

On-Page and Off-Page SEO Strategies

On-page SEO refers to the practice of optimizing individual web pages to rank higher and earn more relevant traffic in search engines. For financial services, this includes:

Title Tag Optimization: Craft compelling, keyword-rich title tags that accurately describe the page content while enticing users to click. For example, “Expert Retirement Planning Services | [Your Company Name]”.

Meta Description Enhancement: Write informative meta descriptions that summarize the page content and include a call-to-action. While not a direct ranking factor, well-written meta descriptions can improve click-through rates from search results.

Header Tag Structure: Use header tags (H1, H2, H3, etc.) to create a logical content hierarchy. This helps both users and search engines understand the structure and main points of your content.

Internal Linking: Implement a strategic internal linking structure to guide users to related content on your site. This not only improves user experience but also helps distribute page authority throughout your site.

Image Optimization: Use descriptive, keyword-rich file names and alt text for images. This is particularly important for financial charts, graphs, and infographics that may contain valuable information.

Content Quality and Depth: Prioritize creating comprehensive, authoritative content that thoroughly covers financial topics. Aim for content that satisfies user intent and provides more value than competing pages.

Off-page SEO involves actions taken outside of your website to improve its search engine rankings. Strategies include:

Link Building: Focus on acquiring high-quality backlinks from reputable financial websites, industry publications, and relevant blogs. This could involve creating linkable assets such as original research reports, financial tools, or insightful market analyses.

Guest Blogging: Contribute guest posts to respected financial blogs and websites. This not only helps build backlinks but also establishes your brand as a thought leader in the industry.

Social Media Engagement: While social signals are not direct ranking factors, maintaining active social media profiles can increase brand visibility, drive traffic to your site, and create opportunities for content sharing and link acquisition.

Online Reputation Management: Monitor and manage your brand’s online reputation. Encourage satisfied clients to leave positive reviews on platforms like Google My Business, especially for local financial services.

Industry Partnerships and Collaborations: Forge partnerships with complementary businesses or participate in industry events. These activities can lead to valuable backlink opportunities and increased brand exposure.

Press Releases and Media Coverage: When your financial institution has newsworthy updates or launches new services, distribute press releases and seek media coverage. This can result in high-quality backlinks and increased brand awareness.

Pay-Per-Click (PPC) Advertising

Overview of PPC for Financial Services

Pay-per-click advertising is a powerful component of digital marketing for financial services. It allows institutions to display targeted ads in search engine results and on partner websites, paying only when users click on these ads. PPC can be particularly effective for financial services due to the high-value nature of many financial products and services, as well as the ability to reach users at critical decision-making moments.

Key benefits of PPC for financial services include:

- Immediate Visibility: Unlike SEO, which can take time to show results, PPC ads can put your services in front of potential clients immediately.

- Precise Targeting: PPC platforms offer sophisticated targeting options, allowing you to reach specific demographics, locations, and even users who have shown interest in financial services.

- Measurable Results: PPC campaigns provide detailed metrics, allowing for precise tracking of ROI and campaign effectiveness.

- Flexibility: Campaigns can be quickly adjusted based on performance, market conditions, or changing business goals.

Creating Effective Ad Campaigns

To create successful PPC campaigns for financial services:

Develop Compelling Ad Copy: Craft ad text that highlights your unique value proposition and includes relevant keywords. For financial services, emphasizing trust, expertise, and specific benefits can be particularly effective. For example, “Expert Financial Advisors | 20+ Years Experience | Free Consultation”.

Use Ad Extensions: Implement various ad extensions to provide additional information directly in your ads. For financial services, consider using:

- Sitelink extensions to direct users to specific product pages or resources

- Call extensions to encourage phone inquiries

- Location extensions for local financial services

- Structured snippet extensions to highlight specific services or products

Create Targeted Landing Pages: Develop specific landing pages for each ad group to ensure a seamless user experience and improve conversion rates. These pages should be highly relevant to the ad content and offer clear calls-to-action (CTAs).

Implement Remarketing Campaigns: Use remarketing to re-engage users who have previously interacted with your website. For financial services, this could include targeting users who have viewed specific product pages but haven’t converted.

Leverage Dynamic Search Ads: For financial institutions with large websites, Dynamic Search Ads can help capture long-tail queries and identify new keyword opportunities.

Utilize Audience Targeting: Take advantage of audience targeting options to reach users based on their interests, behaviours, or life events that may trigger financial service needs.

A/B Test Ad Variations: Continuously test different ad copies, headlines, and CTAs to identify the most effective combinations for your target audience.

Budgeting and ROI Analysis

Effective budget management and ROI analysis are crucial for successful PPC campaigns in the financial services sector:

Set Clear Campaign Objectives: Define specific goals for your PPC campaigns, such as lead generation, account sign-ups, or loan applications. These goals should align with your overall business objectives.

Monitor Key Performance Indicators (KPIs): Track essential metrics such as:

- Click-through rates (CTR)

- Conversion rates

- Cost per acquisition (CPA)

- Quality Score

- Return on ad spend (ROAS)

Implement Conversion Tracking: Set up robust conversion tracking to accurately measure the impact of your PPC campaigns. This may include tracking form submissions, phone calls, or specific high-value actions on your website.

Regularly Analyze Campaign Performance: Conduct frequent reviews of your campaign performance, identifying trends, opportunities, and areas for improvement. Use this data to inform bidding strategies and ad copy optimization.

Utilize Attribution Modeling: Implement advanced attribution modelling to understand the full customer journey and allocate your budget more effectively across different marketing channels. This is particularly important in financial services, where the decision-making process can be lengthy and involve multiple touchpoints.

Consider Lifetime Value: When calculating ROI, factor in the potential lifetime value of a customer, not just the immediate conversion value. This is especially relevant for financial services, where client relationships can be long-term and highly valuable.

Adjust Bidding Strategies: Leverage automated bidding strategies provided by platforms like Google Ads, but regularly review and adjust based on performance and business goals. Consider using strategies like target CPA or target ROAS for more advanced campaign management.

Budget Allocation: Distribute your budget effectively across different campaigns and ad groups based on performance and potential. Be prepared to allocate more budget to high-performing campaigns during peak periods or in response to market opportunities.

Competitive Analysis: Regularly analyze competitor PPC activities to identify gaps in your strategy and potential opportunities. Tools like SEMrush or SpyFu can provide insights into competitor keywords, ad copy, and estimated spend.

Seasonal Adjustments: Be aware of seasonal trends in financial services and adjust your PPC strategy accordingly. For example, tax season might warrant increased budgets for tax-related financial services.

Social Media Marketing

Social media platforms have revolutionized the way financial institutions connect with their customers, build brand awareness, and establish trust. When implementing digital marketing for financial services, it’s crucial to understand and leverage the best practices for social media engagement.

Best Platforms for Financial Services

While the social media landscape is vast, not all platforms are equally suitable for financial services. Here’s an in-depth look at the most effective platforms for digital marketing for financial services:

LinkedIn:

- Ideal for B2B financial services and professional networking

- Allows for sharing industry insights, thought leadership content, and company news

- Offers targeted advertising options to reach specific professional demographics

- Great for recruiting talent and showcasing company culture

Twitter:

- Excellent for real-time updates, customer service, and industry news

- Enables quick dissemination of market updates and financial tips

- Facilitates direct engagement with customers and industry influencers

- Useful for monitoring brand mentions and industry trends

Facebook:

- Perfect for community building and targeting a wide demographic

- Offers sophisticated advertising tools with detailed targeting options

- Allows for the creation of groups to foster customer communities

- Ideal for sharing educational content and promoting financial literacy

Instagram:

- Useful for visual storytelling and reaching younger audiences

- Great for humanizing your brand through behind-the-scenes content

- Effective for showcasing company culture and corporate social responsibility initiatives

- Offers features like Stories and Reels for more dynamic content creation

Building a Social Media Strategy

To create an effective social media strategy for financial services, consider the following detailed steps:

Define your goals and objectives:

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals

- Align social media objectives with overall business objectives

- Examples might include increasing brand awareness, generating leads, or improving customer service

Identify your target audience:

- Develop detailed buyer personas for different customer segments

- Research your audience’s social media preferences and behaviours

- Understand the financial needs and pain points of each segment

Create a content calendar:

- Plan content themes and topics in advance

- Ensure a balanced mix of content types (educational, promotional, engaging)

- Align content with key financial dates, events, and seasons

Develop a mix of educational, promotional, and engaging content:

- Educational: Financial tips, market insights, explanatory videos on complex financial concepts

- Promotional: New product announcements, special offers, success stories

- Engaging: Polls, quizzes, user-generated content, behind-the-scenes glimpses

Establish a consistent brand voice and visual identity:

- Develop brand guidelines for social media communication

- Ensure all posts reflect your brand’s values and personality

- Create templates for consistent visual branding across platforms

Monitor and analyze performance metrics:

- Track engagement rates, reach, and conversions

- Use analytics tools to understand audience behaviour and preferences

- Regularly review and adjust your strategy based on performance data

Engaging with Customers and Building Trust

Social media provides an excellent opportunity to humanize your financial brand and build trust with your audience. Here are some effective engagement strategies, explained in more detail:

Responding promptly to customer inquiries and complaints:

- Set up a dedicated social media customer service team

- Aim to respond within hours, if not minutes

- Use a friendly, empathetic tone in all interactions

Sharing customer success stories and testimonials:

- Highlight real-life examples of how your financial products or services have helped customers

- Use a mix of written testimonials, video interviews, and user-generated content

- Ensure compliance with privacy regulations when sharing customer stories

Providing valuable financial tips and advice:

- Create a series of educational posts or videos on various financial topics

- Offer practical, actionable advice that adds value to your followers’ lives

- Consider partnering with financial experts or influencers for added credibility

Hosting live Q&A sessions or webinars:

- Schedule regular live sessions on topics of interest to your audience

- Invite financial experts from your organization to participate

- Encourage audience participation through questions and polls

Showcasing your company culture and community involvement:

- Share photos and stories from company events and volunteer activities

- Highlight employee achievements and milestones

- Demonstrate your commitment to corporate social responsibility

Email Marketing

Email marketing remains one of the most effective channels for digital marketing for financial services. It allows for direct, personalized communication with customers and prospects, offering numerous benefits and opportunities for engagement.

Benefits of Email Marketing for Financial Institutions

Cost-effective:

- Email marketing offers a high return on investment compared to many other marketing channels

- Minimal costs associated with design, content creation, and distribution

- Ability to reach a large audience at a fraction of the cost of traditional marketing methods

Targeted:

- Reach specific segments of your audience with tailored messages

- Deliver personalized content based on customer data and preferences

- Improve relevance and engagement through segmentation

Measurable:

- Track key metrics such as open rates, click-through rates, and conversions

- Use A/B testing to optimize email performance

- Gain insights into customer behaviour and preferences

Builds relationships:

- Regular communication keeps your brand top-of-mind

- Nurture leads through targeted drip campaigns

- Provide value through educational content and personalized offers

Drives traffic:

- Email campaigns can direct recipients to your website or landing pages

- Increase engagement with your online resources and tools

- Promote specific products or services to interested segments

Crafting Effective Email Campaigns

To create impactful email campaigns for financial services, consider these best practices in more detail:

Use attention-grabbing subject lines:

- Keep subject lines concise (ideally under 50 characters)

- Create a sense of urgency or curiosity

- Personalize subject lines when possible

- Avoid spam trigger words that could affect deliverability

Keep the content concise and focused:

- Use short paragraphs and bullet points for easy scanning

- Focus on one main message or offer per email

- Use clear and simple language, avoiding financial jargon

Include a clear call-to-action (CTA):

- Make your CTA prominent and easy to click

- Use action-oriented language (e.g., “Start Saving Today,” “Learn More”)

- Limit the number of CTAs to avoid overwhelming the reader

Optimize for mobile devices:

- Use a responsive email design that adapts to different screen sizes

- Keep the layout simple and easy to navigate on smaller screens

- Use larger font sizes and buttons for easy tapping on mobile devices

Use a professional, branded email template:

- Create a consistent look and feel that aligns with your brand identity

- Include your logo and brand colors

- Ensure the template is clean, modern, and easy to read

Comply with financial regulations and data protection laws:

- Include necessary disclaimers and disclosures

- Ensure compliance with regulations such as GDPR, CAN-SPAM, and industry-specific rules

- Provide clear opt-out options and honor unsubscribe requests promptly

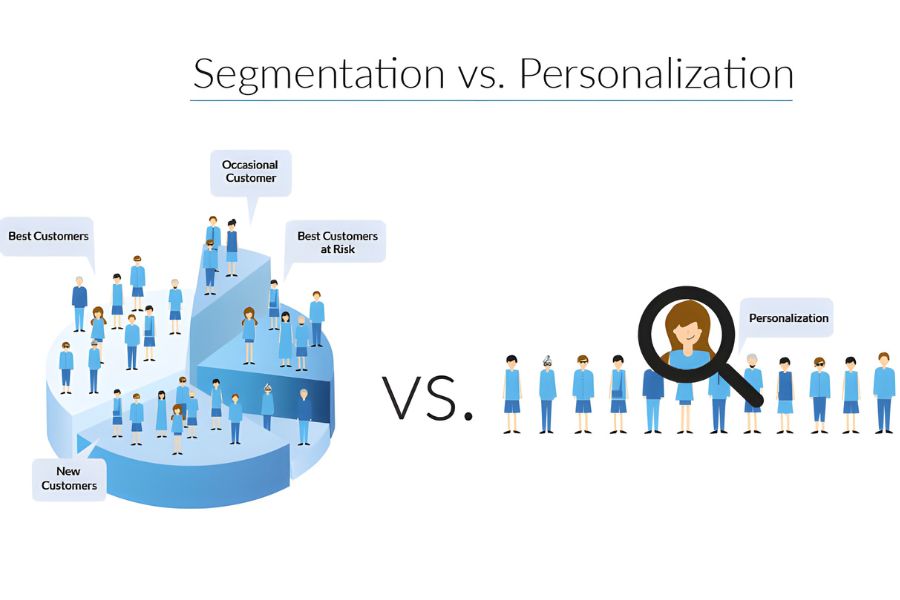

List Segmentation and Personalization

Segmentation and personalization are crucial elements of successful email marketing for financial services. By dividing your email list into specific segments based on demographics, behavior, or preferences, you can deliver more relevant and targeted content. This approach can significantly improve engagement rates and conversions.

Segmentation strategies may include:

Demographics (age, income, location):

- Tailor product recommendations based on life stage or income bracket

- Customize messaging to reflect regional financial concerns or opportunities

- Adjust communication style to resonate with different age groups

Product usage or interest:

- Send targeted emails about specific financial products or services

- Provide updates or tips related to products the customer already uses

- Offer cross-selling opportunities based on complementary products

Customer lifecycle stage:

- Create a welcome series for new customers

- Develop retention campaigns for long-term customers

- Design re-engagement campaigns for inactive customers

Account type or balance:

- Offer premium services or investment opportunities to high-value customers

- Provide budgeting tips and savings products to customers with lower balances

- Tailor communication based on the types of accounts held (e.g., checking, savings, investment)

Past interactions or engagement levels:

- Send follow-up emails based on website interactions or product inquiries

- Adjust email frequency based on engagement levels

- Provide more in-depth content to highly engaged subscribers

Personalization techniques:

Use the recipient’s name in the subject line and email body:

- Go beyond just the first name; consider using full name or title when appropriate

- Incorporate the name naturally into the content for a more personal touch

Tailor product recommendations based on past behaviour:

- Use data on previous purchases or inquiries to suggest relevant products

- Create “next best offer” algorithms to predict what the customer might need

Send triggered emails based on specific actions or milestones:

- Set up automated emails for account openings, anniversaries, or birthdays

- Create alert emails for unusual account activity or approaching financial goals

Customize content based on the recipient’s financial goals or interests:

- Segment your list based on stated financial objectives (e.g., saving for retirement, buying a home)

- Provide targeted advice and product recommendations aligned with these goals

Use dynamic content to personalize email sections:

- Adjust images, offers, or content blocks based on subscriber data

- Create a more relevant and engaging experience for each recipient

Compliance and Regulatory Considerations

Understanding Financial Regulations in Digital Marketing

When implementing digital marketing for financial services, it’s crucial to understand the regulatory landscape. Financial institutions must adhere to various laws and regulations, such as the Gramm-Leach-Bliley Act (GLBA), the Fair Credit Reporting Act (FCRA), and the Dodd-Frank Wall Street Reform and Consumer Protection Act. These regulations impact how financial services companies can market their products and services online.

For example, the GLBA requires financial institutions to explain their information-sharing practices to customers and protect sensitive data. This directly affects how companies can use customer information in their digital marketing efforts. Similarly, the FCRA regulates how consumer credit information can be used in marketing, which is particularly relevant for targeted advertising campaigns.

Ensuring Compliance in Marketing Campaigns

To maintain compliance in digital marketing for financial services, companies should:

- Implement a robust review process for all marketing materials

- Provide clear and accurate disclosures in advertisements

- Avoid misleading claims or guarantees about financial products

- Ensure that all promotional offers are transparent and compliant with regulations

Financial services marketers must work closely with their legal and compliance teams to ensure that all digital marketing initiatives meet regulatory requirements. This collaboration is essential to avoid potential fines and reputational damage.

Handling Customer Data Securely

Data security is paramount in digital marketing for financial services. Companies must implement stringent measures to protect customer information, including:

- Encrypting sensitive data during transmission and storage

- Implementing multi-factor authentication for accessing customer information

- Regularly updating security protocols to address emerging threats

- Training employees on data protection best practices

By prioritizing data security, financial services companies can build trust with their customers and comply with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Analyzing and Measuring Success

Key Performance Indicators (KPIs) for Financial Services

To evaluate the effectiveness of digital marketing for financial services, companies should track relevant KPIs, such as:

- Customer acquisition cost (CAC)

- Conversion rates for different products or services

- Customer lifetime value (CLV)

- Engagement metrics (e.g., email open rates, click-through rates)

- Return on investment (ROI) for marketing campaigns

These KPIs help financial services companies understand the impact of their digital marketing efforts and make data-driven decisions to improve their strategies.

Tools and Techniques for Measuring Performance

Several tools and techniques can be used to measure the performance of digital marketing for financial services:

- Web analytics platforms (e.g., Google Analytics) to track website traffic and user behavior

- Customer relationship management (CRM) systems to monitor lead generation and conversion

- Social media analytics tools to measure engagement and reach

- A/B testing platforms to optimize marketing messages and designs

- Attribution modeling to understand the customer journey across multiple touchpoints

By leveraging these tools, financial services marketers can gain valuable insights into their digital marketing performance and identify areas for improvement.

Adjusting Strategies Based on Analytics

The key to successful digital marketing for financial services lies in continuously analyzing performance data and adjusting strategies accordingly. This may involve:

- Reallocating budget to high-performing channels

- Refining target audiences based on engagement data

- Optimizing content and messaging to improve conversion rates

- Experimenting with new digital marketing tactics and platforms

By adopting an agile approach to digital marketing, financial services companies can stay ahead of the curve and maximize their marketing ROI.

Future Trends in Digital Marketing for Financial Services

As technology continues to evolve, digital marketing for financial services is poised for significant changes in the coming years. Financial institutions must stay ahead of these trends to remain competitive in the digital landscape.

Emerging Technologies and Their Impact

Several emerging technologies are set to reshape digital marketing for financial services:

- Artificial Intelligence (AI) and Machine Learning: These technologies will enable more sophisticated personalization, predictive analytics, and automated customer service.

- Voice Search and Smart Assistants: As voice-activated devices become more prevalent, financial services will need to optimize their digital marketing strategies for voice search.

- Augmented Reality (AR) and Virtual Reality (VR): These technologies could revolutionize how financial products and services are demonstrated and experienced by customers.

- Blockchain: While primarily associated with cryptocurrencies, blockchain technology could also impact digital marketing by enhancing data security and transparency in financial transactions.

Predictions for the Next 5-10 Years

Looking ahead, experts predict several key developments in digital marketing for financial services:

- Hyper-personalization: Marketing messages and product recommendations will become increasingly tailored to individual customers based on their financial behaviour and preferences.

- Increased focus on data privacy: As concerns about data security grow, financial institutions will need to balance personalization with robust data protection measures.

- Integration of financial services into daily life: Digital marketing efforts will focus on seamlessly integrating financial products and services into customers’ everyday activities and decision-making processes.

- Rise of fintech partnerships: Traditional financial institutions will increasingly collaborate with fintech companies to enhance their digital marketing capabilities and offer innovative services.

Preparing for Future Challenges and Opportunities

To succeed in the evolving landscape of digital marketing for financial services, institutions should:

- Invest in data analytics and AI capabilities to better understand and serve their customers.

- Develop a culture of innovation and agility to quickly adapt to new technologies and market trends.

- Focus on building trust and transparency through their digital marketing efforts.

- Continuously upskill their marketing teams to keep pace with technological advancements.

- Stay informed about regulatory changes that may impact digital marketing practices in the financial sector.

By embracing these future trends and preparing for upcoming challenges, financial services providers can position themselves for success in the digital age. As digital marketing for financial services continues to evolve, those who adapt and innovate will be best equipped to meet the changing needs and expectations of their customers.

FAQs: Frequently Asked Questions

Digital marketing for financial services involves using online channels and strategies to promote financial products and services. This includes content marketing, social media marketing, email marketing, SEO, and PPC advertising tailored to attract and engage clients in the finance sector.

Digital marketing is crucial for financial services because it helps reach a broader audience, builds trust and credibility, and enhances customer engagement. It allows financial institutions to effectively communicate their value propositions, stay competitive, and drive business growth in a digital-first world.

Effective digital marketing strategies for financial services include:

- Creating informative and engaging content that addresses customer pain points.

- Utilizing SEO to improve search engine rankings.

- Running targeted PPC campaigns.

- Leveraging social media platforms to build a community and engage with clients.

- Implementing email marketing campaigns to nurture leads and retain customers.

Financial services can ensure compliance by:

- Understanding and adhering to industry regulations and guidelines.

- Clearly disclosing all necessary information in marketing materials.

- Implementing strong data protection and privacy measures.

- Regularly reviewing and updating marketing practices to align with regulatory changes.

Financial services can measure the success of their digital marketing efforts by tracking key performance indicators (KPIs) such as website traffic, conversion rates, lead generation, engagement rates on social media, and return on investment (ROI) from marketing campaigns. Analyzing these metrics helps refine strategies and improve overall performance.

Conclusion

At RK Media, As a Digital Marketing Agency, we understand that digital marketing for financial services is a complex and dynamic field. Our approach is comprehensive, blending personalization, educational content, and trust-building strategies to help our financial sector clients thrive in the digital landscape.

We pride ourselves on staying at the forefront of technological advancements, consumer behaviour shifts, and regulatory changes. Our team of experts continually refines strategies, tests innovative approaches, and meticulously analyzes results to maximize the effectiveness of our clients’ digital marketing campaigns.

Our ultimate aim is to deliver value to your customers throughout their financial journey. From raising awareness and providing education to supporting consideration and decision-making processes, we craft strategies that foster enduring relationships between financial institutions and their clientele. With RK Media as your partner, you’ll be well-equipped to navigate the challenges and seize the opportunities in today’s digital-first, highly competitive financial services market.